Cash Flow 101

Cash flow sounds like a relatively simple concept, and in some ways it is, but poor cash flow management can take down a small business, a lifestyle, and sometimes your level of happiness. You must spend your money on assest and be very aware of your liabilities. Do you know the difference between liabilities and assets?

Cash flow is equally critical for households. If you miss a paycheck when bills come due and you have no reserve funds available, you will incur losses in terms of late payment fees and other potential penalties.

Assets Vs Liabilities Vs Equity

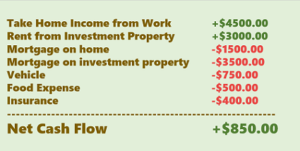

How do you manage cash flow? First, you have to track it properly. Businesses do so with a cash flow statement (CFS) and homes by means of a household budget.

For businesses, a CFS covers the flow of cash in and out over a particular period of time. Start with net earnings, which is the cash from revenue minus expenses (cost of goods sold, taxes, etc.). From there, adjustments are made based on other flows of cash in and out from operations, investing activities, and financing activities.